Version 1: Is Sam Altman Using Stock-Only Purchases to Dilute OpenAI’s Nonprofit Power?

Title: Exploring Speculations Around Sam Altman’s Acquisition Strategies at OpenAI

In the ever-evolving world of artificial intelligence, recent acquisition activities surrounding OpenAI have sparked intriguing discussions regarding the organization’s structure and control dynamics. This post delves into a theory suggesting that Sam Altman, the company’s CEO, may use all-stock acquisitions to subtly diminish the nonprofit’s control over OpenAI Global LLC.

Recent Developments

OpenAI has recently made headlines with two significant acquisitions: io, a startup founded by renowned designer Jony Ive, at a valuation of $6.5 billion, and Windsurf, an AI coding tool, for $3 billion. What’s noteworthy about these transactions is that both were executed entirely in stock. An emerging theory, drawing attention from various online forums, proposes that these strategies might be an effort to dilute the nonprofit’s controlling stake, potentially sidestepping legal restrictions that prevent OpenAI from shifting to a for-profit entity.

Understanding OpenAI’s Complex Structure

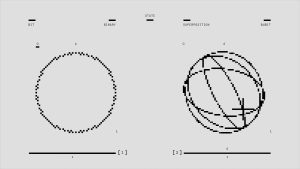

The organizational hierarchy of OpenAI is intricate:

- OpenAI Inc (the nonprofit) oversees OpenAI Global LLC (the for-profit arm).

- The nonprofit status is crucial for maintaining OpenAI’s mission to benefit humanity as a whole.

- Financial returns for investors are capped at a maximum of 100 times their investment, with any excess profits directed back to the nonprofit itself.

- This unique arrangement presents challenges in securing capital for expansion and operational needs.

Considering the substantial investments made, totaling approximately $10 billion in stock dilution, one can’t help but wonder about the implications for control over the organization. The actual percentage of ownership retained by the nonprofit remains undisclosed, adding a layer of complexity to these dealings.

Analyzing Control Dynamics

The extent to which the nonprofit maintains its control influences how much stock might be required to dilute that stake significantly. For instance:

- If the nonprofit holds 99%, roughly $300 billion in stock exchanges would be necessary.

- A 55% holding would need around $30 billion, while a 51% ownership would necessitate approximately $6 billion.

The crux of the matter lies in the nature of the shares involved in these acquisitions: Are they economic shares, or do they carry voting power? While some speculate that the shares in question are from OpenAI Global LLC, the lack of clarity leaves room for uncertainty.

A Historical Context

Interestingly, this scenario isn’t the first time Altman

Post Comment