Exploring the Idea: Is Sam Altman Leveraging Stock-Only Acquisitions to Erode OpenAI’s Nonprofit Authority?

Is Sam Altman Strategically Diluting Nonprofit Control Through All-Stock Acquisitions?

In recent weeks, OpenAI has made headlines with its substantial acquisitions, such as the recent purchases of io for $6.5 billion and Windsurf for $3 billion, both funded entirely through stock. This has sparked a compelling theory on platforms like Hacker News, suggesting that Sam Altman might be leveraging these all-stock transactions to gradually reduce the nonprofit’s controlling stake in OpenAI Global LLC, potentially navigating around legal restrictions that constrain the conversion to a for-profit model.

Understanding the Organizational Structure

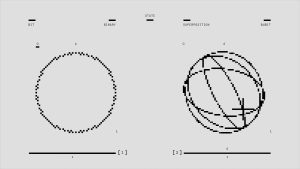

The operational structure of OpenAI is notably intricate, and while the specifics about its shareholders remain somewhat obscure, a few key facts have emerged:

- OpenAI Inc operates as a nonprofit entity overseeing OpenAI Global LLC, which is a for-profit venture.

- To fulfill its mission of benefiting humanity, the nonprofit must maintain significant oversight.

- Investors are limited to a maximum return of 100x their investment, with any surplus directed back to the nonprofit.

- This unique arrangement complicates capital fundraising efforts for future growth.

Recent All-Stock Acquisitions

The move to engage in all-stock deals has raised eyebrows:

- io (founded by Jony Ive): Acquired for $6.5 billion in stock.

- Windsurf (an AI coding tool): Acquired for $3 billion in stock.

- Totaling approximately $10 billion in stock dilution.

The effectiveness of these deals in diluting the nonprofit’s controlling stake largely hinges on the percentage of ownership it currently holds—information that OpenAI has not transparently disclosed (although they assert “full control,” which leaves room for interpretation):

- If the nonprofit holds 99%, it would require around $300 billion in stock deals to affect control.

- If it holds 55%, around $30 billion would be necessary.

- If it holds 51%, somewhere around $6 billion would need to be raised.

The ambiguity surrounding these stock transactions—whether they involve economic shares or voting rights—remains a crucial factor. It is suggested that these deals could be structured with OpenAI Global LLC shares, although it’s still not definitively clear.

A Historical Parallel: The Reddit Episode of 2014

Interestingly, this isn’t Sam Altman’s first engagement with a challenging corporate maneuver. Back in 2014, he reportedly executed

Post Comment